loveland co sales tax form

Form 990 Revenue. Line 8 City Use Tax.

Line 6 to line 5 and enter the total on this line 7.

. Hours Please call or visit website for. Contact Info Executive Officer Name and Phone Number. The Loveland Sales Tax is collected by the merchant on all qualifying sales made within Loveland.

The loveland colorado sales tax is 655 consisting of 290 colorado state sales tax and 365 loveland local sales taxesthe local sales tax consists of a 065 county sales tax and a 300 city sales tax. 500 East Third Street Ste. Line 7 Total City Sales Tax.

Dealers and TAX-EXEMPT BUYERS. Larimer Countys service fee vendor fee will remain the same at 222. Available with membership or.

The vendors fee previously deducted on line 8 was repealed for tax periods beginning January 1 2011. Loveland CO Sales Tax Rate. The Department of Revenue will update both the DR0100 Retail Sales Tax Return paper form and the sales tax return on Revenue Online to reflect the new county rate.

The Loveland Colorado sales tax is 655 consisting of 290 Colorado state sales tax and 365 Loveland local sales taxesThe local sales tax consists of a 065 county sales tax and a 300 city sales tax. Ste 100 loveland co 80537 get directions. If you need to report a crime or ask a police related question please call the Larimer County Sheriffs Office at 970-416-1985.

An alternative sales tax rate of 765 applies in the tax region Windsor which appertains to zip code 80538. The County sales tax rate is. If you cannot file through Revenue Online or another electronic method please download the form you need.

DR 0155 - Sales Tax Return for Unpaid Tax from the Sale of a Business. You can get the best discount of up to 65 off. If you have an emergency please call 911.

Food Sales Tax and Utility Rebate Past Years Totals 2017 2016 2015 Number of Rebates Processed 598 597 694 Food Rebate Issued 66835 70168 79759. Food for home consumption B. DR 0154 - Sales Tax Return for Occasional Sales.

The December 2020 total local sales tax rate was 6700. 80537 80538 and 80539. Centerra Retail Sales Fee Corporation.

This is the total of state county and city sales tax rates. Share Bookmark Share Bookmark Press Enter to show all options press Tab go to next option. To Pick Up an Application.

The Loveland Colorado sales tax rate of 67 applies to the following three zip codes. Groceries are exempt from the Loveland and Colorado state sales. Combined sales tax rate of 545.

Larimer County Sales and Use Tax Exemptions. For tax years 2015 and prior the Loveland Income Tax Code Chapter 183 Section 07 requires individual taxpayers having estimated taxes due in excess of 10000 to pay on a quarterly billing schedule. Beginning with sales on January 1 2018 the Colorado Department of Revenue CDOR will be requiring ALL Colorado sales tax licensees to report and pay sales tax to the penny regardless of filing format.

This is an estate sale conducted in Loveland Colorado and sales tax is required to be charged in the amount of 67. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Loveland Colorado Sales Tax Permit. Sales Tax Services in Revenue Online.

Loveland Estes Park Greeley Fort Collins Number of family members 1 1 1 1 Income 26900 26900 25700 26900. The current total local sales tax rate in Loveland CO is 3700. Please be advised that you will be required to show an original valid in-state sales tax certificate as well as provide an email address for receipt.

The total amount of sales tax calculated on line 7 must be remitted to the City. The Colorado sales tax rate is currently. Services Finance Sales Tax.

Web Go to site. CR 0100AP - Business Application for Sales Tax Account. A Loveland Colorado Sales Tax Permit can only be obtained through an authorized government agency.

Welcome to Sales Tax. City of Love-land 175 State of Colorado 29 and Larimer County 08. Third Street Loveland CO 80537 Phone.

Machinery and machine tools. Enter the total purchases subject to. Noncompliance results in a penalty equal to 10 of the tax remaining due over 10000 after the estimated payment deadline of January 31.

Tangible Personal Property Purchase Suit 6500 Shoes 2000 8500 PIF 125 106 RSF 10 085 8691 Sales Tax 545 474 Total 9165 Non-Taxable Purchase. The sales tax break down is as follows. DR 0100 - Retail Sales Tax Return Supplemental Instructions DR 0103 - State Service Fee Worksheet.

Business registrationsales tax application. DR 0235 - Request for Vending Machine Decals. 2725 Rocky Mountain Avenue.

The minimum combined 2022 sales tax rate for Loveland Colorado is. An alternative sales tax rate of 77 applies in the tax region Berthoud which appertains to zip code 80537. Phone 970 342-2292 City of Loveland.

Organization Name Address. The Loveland sales tax rate is.

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Printable Addendum To Employee Handbook Template Word Example Employee Handbook Template Proposal Templates Quote Template

Colorado Small Businesses Likely To Get Delay On New Sales Tax System Denver Business Journal

Telangana Sales Tax Registration Certificate Accounting Taxation Sales Tax Registration Tax

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Form Dr 0800 Fillable Location Jurisdiction Codes For Sales Tax Filing

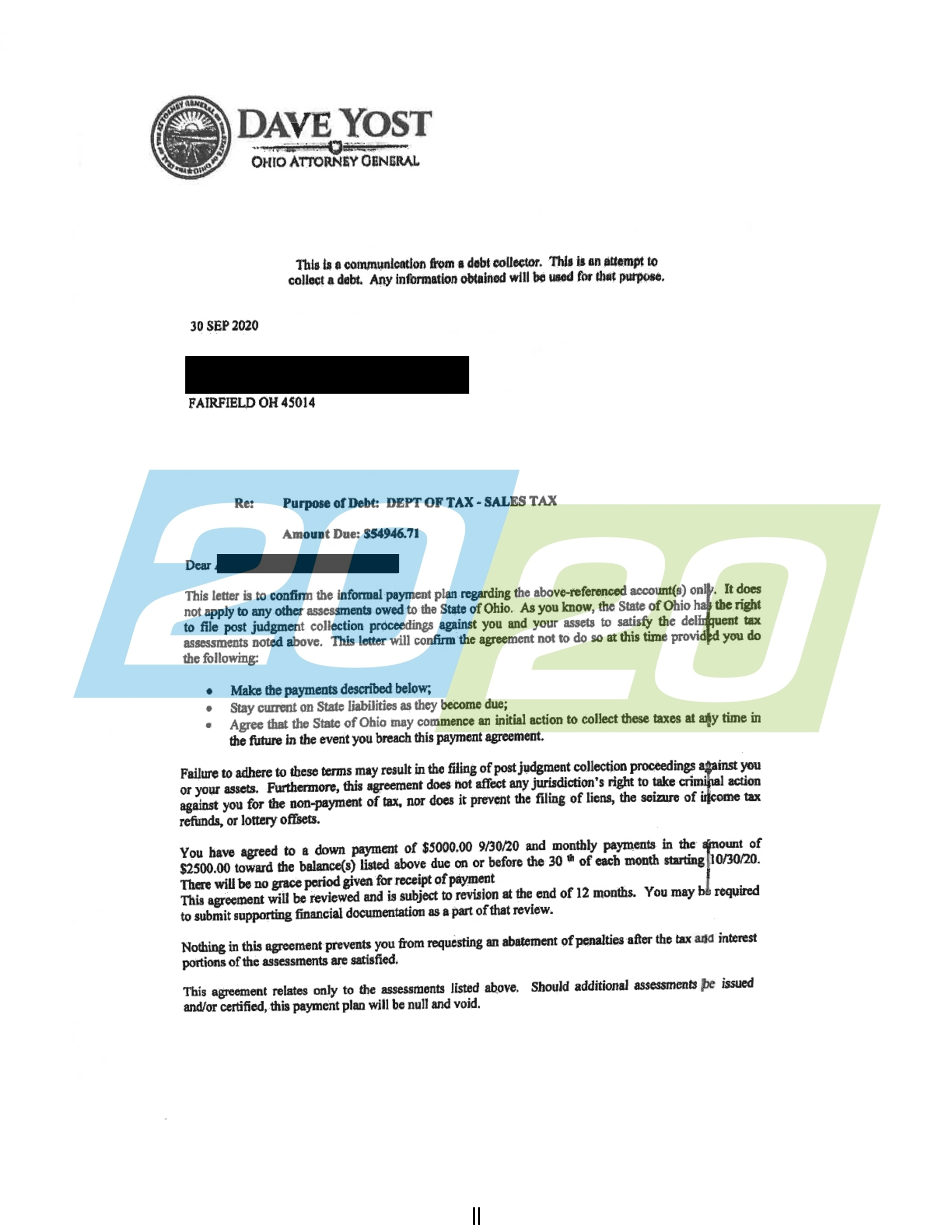

Tax Settlements Earned In Ohio 20 20 Tax Resolution

Online Sales And Use Tax Return Filing And Payment City Of Longmont Colorado

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Register For A Sales Tax Permit In The State Of Virginia Business Solutions Virginia Sales Tax

Sales Tax Worksheets Money Worksheets Money Math Worksheets Money Skills

Sales Tax Word Problems Word Problems Math Word Problems Math Words

Ntn Tax Filer Pra Gst Chamber Tm Logo Reg Income Sales Tax Return E Filling Audit Notice Handling Tm Logo Tax Advisor Gulberg

Register New Businesses In Colorado Colorado Business Express Business State Of Colorado Colorado

Loveland Wants Colorado To Settle Netflix Sales Tax Issue Loveland Reporter Herald

Renew Your Sales Tax License Department Of Revenue Taxation

Sales Tax Revenue In August Up From 2019 Estes Park Trail Gazette